Viasat Achieves First In-Flight Connectivity Type Certification in China

Viasat has achieved the first type certification for its in-flight connectivity system in China on the Airbus A320.

The Civil Aviation Administration of China (CAAC) issued a Validation of Supplemental Type Certificate (VSTC) to the satellite operator for the installation of Ka-band satellite systems on Airbus A320s. Under the new VSTC, A320 operators based in China can modify their aircraft with Viasat’s antenna, radome, modem, server, and wireless access points (WAPs).

According to Viasat, the new VSTC was issued based on an Airbus A320 STC previously certified by the European Union Aviation Safety Agency (EASA). Xinhua, a Chinese media outlet managed by China’s government, in February published an update noting that Airbus plans to deliver the 600th A320 family aircraft assembled at its final assembly line in north China’s Tianjin Municipality this year.

Don Buchman, Viasat’s vice president and general manager, Commercial Aviation, called their first Chinese type certification “significant because Chinese-based airlines, using our best-in-class equipment, are now a step closer to delivering an on-the-ground internet experience to their passengers while in-flight. We’re grateful to our partners in China for their support and are committed to continuing to invest in this important market—where we have operated since 1994—for the long run.”

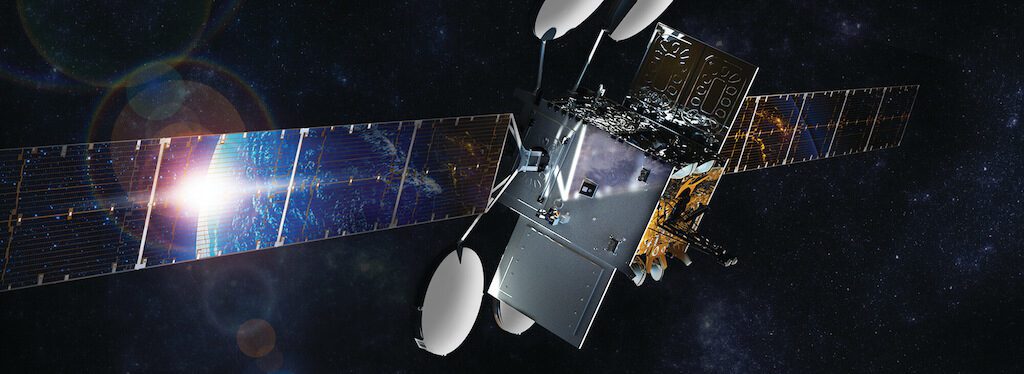

Viasat’s CAAC A320 type certification comes following a November agreement established with China Satellite Communications (China Satcom) that will allow the satellite operator to offer its Ka-band service to domestic and international airlines via the Ka-band ChinaSat-16 satellite system.

Viasat Introduces New IFC Antenna System

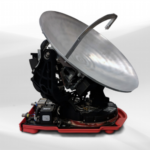

Viasat revealed the availability of its new Ka-band Global Aero Terminal (GAT-5518) to provide In-Flight Connectivity (IFC) services on government and business aviation aircraft — from government-focused Unmanned Aerial Vehicle (UAV) and fixed-wing military platforms to VIP business and corporate jets. The GAT-5518 is the latest satellite communications (SATCOM) product to join Viasat’s portfolio of Ka-band aero antenna systems. The GAT-5518 terminal completed the Federal Aviation Administration (FAA) D0-160G certification process. This certification confirms the terminal’s ability to provide IFC services across the International Telecommunication Union (ITU) Ka-band spectrum, which includes commercial and Mil-Ka frequency bands; across varying polarity layouts; across multiple orbital regimes, including both Medium Earth Orbit (MEO) and Geosynchronous Orbit (GEO) satellite systems; and across multiple network and ground infrastructures. The terminal is also expected to be forward-compatible, enabling it to leverage current and future Viasat satellite systems, as well as operate over third party satellite networks. The terminal is made up of a two-axis steerable, two-way Ka-band antenna with an integrated antenna control unit (ACU), an antenna power supply unit and a modem. The GAT-5518’s antenna can be tail, fuselage or hatch-mounted.

New Analytics, Antenna and Cable Technology at AIX 2019

Avionics manufacturers and aircraft connectivity service providers are responding to airlines’ demands for faster connection speeds, more flexible architectures and aircraft data analytics platforms at the 2019 Aircraft Interiors Expo (AIX) 2019 in Hamburg, Germany. Here are some of the newest connected aircraft technologies and components that made their public debut on the second day of AIX. Panasonic Unveils ‘Insights’ Data Analytics Panasonic unveiled the latest component of its NEXT platform: a cloud-based analytics solution that harvests data from onboard and third-party sources from a wide range of touchpoints, including entertainment, connectivity, social media, location and weather monitors. It analyzes this data to help airlines improve the onboard passenger experience, pre-emp maintenance needs and drive revenue. Airlines will also have access to seasonal and temporal trends data through Insights, with the ability to benchmark their performance against industry averages and KPIs. Insights will be accessible via a secure dashboard on mobile devices. It has two components: A Software-as-a-Service (SaaS) application and Consulting. The SaaS component offers the data and insights described above while the Consulting piece offers airlines tailored solutions for specifics challenges. Consulting will also release monthly trends reports based on Panasonic’s global data, available by monthly subscription. “Airlines today have access to more data points than ever before, and Panasonic’s Insights solution takes all the leg-work out of analyzing and leveraging that data,” said David Bartlett, chief technology officer of Panasonic Avionics Corporation. “By fully integrating Insights across every aspect of their passenger experience, airlines will be able to use the information it delivers to optimize their passenger experience and business performance,” he added. “It is solutions like this that will enable airlines to remain competitive in the saturated market place and continue to grow their market share.” Insights will be available in the second half of 2019, according to Panasonic. Viasat’s Second-Generation Hybrid Ku/Ka-band System Viasat has a new second-generation Ku-/Ka-band shipset, including a hybrid antenna and complimentary radome. The shipset will allow airlines to provide connectivity via today’s Ku- and Ka-band networks as well as prepare for the global ViaSat-3 constellation planned for launch in 2021 and 2022. “Hybrid antenna systems are not new to Viasat—we have nearly two decades of experience deploying and managing these systems,” said Don Buchman, vice president and general manager for commercial Aviation at Viasat. “Similar to the first generation, Viasat’s latest dual-band system promotes smooth transitions among multiple satellite beams across Ku- and Ka-band networks.” When flying on routes with the hybrid shipset installed, customers will have in-flight access to all Ka-band satellites currently participating in Viasat’s global network. When out of Ka-band coverage, service will switch to the Ku-band network. Once the Viasat-3 constellation is fully deployed — which the company estimates will happen in 2022 — global Ka-band coverage will be available. SmartSky Selects Gore’s Vapor-Sealed 7 Series Cable Assemblies SmartSky Networks selected Gore’s vapor-sealed 7-series for their new in-flight connectivity system that provides 4G LTE air-to-ground (ATG) connection in aircraft such as the Embraer ERJ-135 operated by JetSuiteX. The connectivity system has now received supplementary type certification for the ERJ-145. “Gore’s 7 Series is high performance and exceptionally reliable, enabling a real fit-and-forget installation to exceed our customers’ expectations now and for many years to come,” said Darren Emery, vice president for product support at SmartSky.

Viasat, China Satcom Bring IFC to Airlines Over China

Viasat and China Satellite Communications (China Satcom) entered into a strategic partnership to jointly provide In-Flight Connectivity (IFC) services within China for domestic and international airlines. Viasat and China Satcom will help enable Viasat’s global airline customers to have roaming connectivity when flying over China; provide IFC service to domestic flights within China; and enable Chinese airlines to roam onto Viasat’s global network. China Satcom is a licensed telecommunications service provider in China and also owns and operates a Ka-band spotbeam satellite system in China, which is the only Ka-band system currently available for IFC service in the country. Yet today, only about four percent of flights within China are connected. “Our agreement with China Satcom is a significant step towards realizing a seamless global community of high performance IFC. China Satcom is now the only satellite operator and licensed service provider in China with the bandwidth resources to deliver the in-flight experience our airline customers have come to expect and depend on,” said Don Buchman, vice president and general manager, Commercial Aviation, Viasat. “Our partnership is a natural way to extend state-of-the-art services specific to China Satcom’s fleet and the China domestic market, and create a global roaming alliance for our existing and new domestic and international customers and the rapidly growing Chinese global commercial airline fleet. We are honored to work with China Satcom in China to make IFC-at-scale a reality.”

JetBlue’s Stoyanova Looks to the IFC Horizon

Mariya Stoyanova, JetBlue’s head of product development, is the very definition of an In Flight Connectivity (IFC) influencer. She is one of the leaders behind JetBlue’s remarkable progress in the IFC arena. She, along with her team, have big ambitions to make JetBlue the standard when it comes to IFC. But, what does she think of the satellite industry and what does she want from the tech industry?

Mariya Stoyanova, JetBlue’s head of product development, is the very definition of an In Flight Connectivity (IFC) influencer. She is one of the leaders behind JetBlue’s remarkable progress in the IFC arena. She, along with her team, have big ambitions to make JetBlue the standard when it comes to IFC. But, what does she think of the satellite industry and what does she want from the tech industry?

It is a sunny autumnal day in Boston, a city I haven’t visited for almost two decades, but the venue for The Airline Passenger Experience Association (APEX) Expo — one of the key events for the airline industry when it comes to IFC. One of the highlights of the trip was sitting down with Stoyanova to talk about satellite tech, customer partnerships, passenger experience, and all things in between. Stoyanova is both candid and forceful at the same time while making a point. As a ‘blue chip’ customer for the satellite industry, when Stoyanova (and JetBlue) talks, the industry should listen.

JetBlue’s first connected aircraft was introduced around five years ago. It was part of its value proposition when the airline came into operation. It reached 100 percent fleet connectivity in 2017, which was a significant milestone. The company, a leisure based airline, has put IFC front and center in its strategy. Stoyanova admitted that she considers JetBlue, even in the hyper competitive North American market, “the market leader” when it comes to IFC. “We are more customer friendly than other carriers, as I believe it is more part of our JetBlue customer value proposition rather than an ancillary revenue strategy. This is where our strategy differs from other carriers. Our free product is better than most paid products that are being offered currently, especially in the U.S. market. I think that is the future. We do believe in seamless, uninterrupted living and removing those anxiety moments from the customer experience by providing them with a service they can rely on.”

One of the themes of APEX last year was larger airlines placing more of an emphasis on IFC. Stoyanova says the industry is “shifting” — especially the onboard experience. The experience used to be a commodity, and she believes that airlines became complacent in the way the way they sold and marketed IFC to customers. “Other airlines are investing in the product and moving towards a better experience overall,” she adds. “Where I still think I have the edge is we have a pretty consistent aircraft type. It is easier to sustain it. We operate the A320 family and now we will have the A220 family. We have a relatively consistent product offering. We have seatbacks at every seat. So, I think the consistency of the product and consistency of the fleet gives me a little bit of an edge from being simple and being able to manage the product and the offering better.”

Satellite Technology and What Stoyanova Wants?

JetBlue is one of the Viasat’s most high profile airline customers. Stoyanova came into the role when going down the Ka-band route had already been decided. She admits it was “definitely a risky” journey to go down, considering that at that time, not many (if any) airlines had decided to pursue Ka-band. “The first test flight we had with Viasat, we all looked at each other and said: this better work,” she says. “The first test flight was in 2013. I was part of the sourcing team at that point. I came at it from a different lens and different angle. But, it was very exciting.”

Stoyanova spoke to the value in Viasat’s satellite technology. “The value with Viasat is outside of their product,” she says. “They have the service on the ground. They have learnings on the ground that I can transfer into the air, which is very helpful. In terms of satellite technology, it is only getting better. They listen to our feedback and offer us solutions to optimize the product so we can provide a better experience.”

She says the technology industry (implying the satellite industry) is moving too slowly. She says that the lead times are “insane,” and unfortunately, the real world is moving much faster. “I understand how the aviation world works. Customers are getting more and more demanding so creating systems that provide flexibility and are future proofed will help me a lot. Things are changing so fast,” she says.

But how much satellite capacity is JetBlue actually using? While Stoyanova does not give an exact figure, she admits how the bandwidth is changing significantly. She points to the fact that years ago, there were no videos on Facebook’s newsfeed, and that there were no Instagram stories. These platforms have now become “essential” to customers but for JetBlue, they will need greater bandwidth to cope.

Using Satellite Providers Other Than Viasat

While JetBlue is undoubtedly happy with its work with Viasat, many other satellite operators are targeting the IFC market. As airlines examine their options moving forward, JetBlue could work with other providers. With many new satellites being launched in different orbits, is JetBlue actively considering other satellite companies for its IFC needs? “Whenever we have a retrofit program underway or a new aircraft type coming in, we always explore our options,” she says. “We have just ordered more than 60 A220s, so we are in the process of selecting IFC and connectivity providers. We’re always on the lookout for what’s new in the connectivity realm, but Viasat is the standard right now.”

Cracking the Code

In a recent interview with Via Satellite, Andrew Middleton of easyJet said no airline had cracked the IFC code or found the magic formula to be successful. So despite JetBlue’s success, does Stoyanova believe that JetBlue or another airline has cracked the code? “The way most airlines look at it is the revenue share model and the paid product. The partnerships are a part of it as well. People think we have a secret sauce. I don’t,” she says. “I just took a different path. We need to optimize for customer experience rather than talk about Service Level Agreements (SLAs) and Key Performance Indictators (KPIs). The industry is shifting, especially the onboard experience. It’s no longer about a plane taking you from point A to point B. Customers are not looking for a commodity, they are looking for an experience.”

Partnerships

Most airlines are getting connected. Some like JetBlue may have done it quicker than others, but most are connected or in the midst of getting connected. It means that to stand out from the crowd, airlines may have to partner with others to improve the overall experience. JetBlue has worked with Amazon in an innovative partnership, that allows JetBlue customers access to their Amazon services. They can stream, listen to music and shop. JetBlue promotes all those things when you are onboard. Stoyanova says these are not hooks designed for customers to pay the airline more. They are hooks for customers to have a better experience.

In terms of other partnerships, Stoyanova admits she sees a lot of value in them. “With Amazon, they saw the value in us owning the whole customer experience and them integrating into our system. For Amazon, those are people that are in a aircraft at 35,000 feet. You want get their attention for the duration of the flight,” she says. “So, this is totally incremental to everything else that you do. You have the ability to organically convert customers as you have your product in the air. The fact we offer Fly-Fi for free means this is completely organic and it is self-selected. It is not a forced offering. This is why it takes time to educate companies to build partnerships, but once they understand it, they see the results from the previous partnerships we have done, they jump on board.”

Yet, has the partnership with Amazon created any bandwidth bottlenecks? “When we set-up the partnership with Amazon, the three of us (JetBlue, Viasat and Amazon) did work hard to make sure the streaming product was optimized for our Fly-Fi product,” Stoyanova says.

The Next Chapter

Stoyanova is unphased about the epiphanies that some airlines seem to have had recently regarding IFC. She admits that in lieu of monitoring the competition, she gets her inspiration from outside the airline industry. “I look at the hospitality industry,” she says. “I would look at the Disney experience, for example. You would have some of the hotel chains as they are good at delivering curated services. Hospitality is really important. In Flight Entertainment (IFE) is just part of what we do. We own the whole onboard experience so food and beverage, the interiors, and the ground experience. For us, hospitality is a big part of what we do. If the inflight and airports crewmembers are not invested, it doesn’t work. Everybody has to be invested in it for it to work.”

She says her job is “getting more interesting,” but doesn’t believe it is getting harder. “I don’t like to get comfortable, [because] then you get complacent. I think this happened to a lot of the carriers back in the day. Airlines like JetBlue started to make them feel uncomfortable because they put something in the market that is providing more customer value. It made them move faster and in the right direction. I am happy for that. Challenging is not necessarily badshe says.

In terms of what is on deck for the airline over the next year, Stoyanova says the airline has a “a lot of big things coming up.” It has started retrofitting all of its A320s, so it will have a new IFE platform, interiors, etc. There will also be new portals. “I am looking forward to seeing how that will perform. We also have the A220s coming up,” Stoyanova says.

Check out the full version of this article as first published in Via Satellite.

How Qantas is Developing New Connected Cockpit Applications

Qantas A330 and 737 pilots are in the midst of evolving their flight operational data visualization strategy. Software upgrades added to the existing wireless aircraft interface devices on those models will bring the airline into a new era of connected iPad functionality.

We recently caught up with Peter Alexander, manager of technical programs at Qantas Airways, to discuss how the airline has been upgrading its fleet of A330s and 737s to provide its pilots with access to real time turbulence alerting. Right now, the Australian carrier is completing installations of hybrid Ku/Ka-band antennas to enable access to ViaSat’s Ka-band and Australian domestic broadband provider NBN’s Ku-band satellite networks throughout the continent of Australia.The aircraft interface device (AID+) that Qantas has upgraded to features a wireless router, ACARS proxy service and ARINC 429/717 aircraft parameter streaming via port based application programmable interfaces. Inside the cockpit the AID+ enables communication between the wireless iPad applications used by pilots and the embedded ARINC 429 data streams. It also links pilot apps to the internet to enable the use of web charts maps and weather.

“We have been using Apple’s iPad as an electronic flight bag for the last five years and have become very much embedded within the Apple iOS ecosystem. Being able to add the satellite connectivity to that in combination with the AID+ enables GPS own-ship capability for our pilots using Jeppesen charts. Because the AID+ is connected to the ViaSat system, we get retain general Internet capabilities as well,” said Alexander.

Using iPads in combination with the avionics upgrades will also help Qantas pilots to improve their situational awareness by giving them improved access to long range weather. According to Alexander, prior to introducing the iPad, pilots were mostly limited to the 200 nautical mile visibility of weather that the weather radar on legacy aircraft are capable of.

The goal is to give pilots information about weather further out in front of the aircraft using the iPad and connectivity to visualize the Australian Bureau of Meteorology’s weather forecasting throughout all phases of flight.

Teledyne also included a software developer kit functionality within their AID+ which allows Qantas to develop their own third-party iPad applications that can communicate with the AID+.

“The software upgrade to our AID+ effectively establishes a simulator and development tool available free of charge from our website. This tool makes it very easy for airlines or third-party software developers to build and test new applications on the ground that can interface with GroundLink AID+ airborne AID. Qantas, which has a particularly strong IT function within its operation, and has been using this tool to build and test its own and third-party applications prior to deployment on the aircraft,” said Murray Skelton, director of aircraft solution strategy at Teledyne Controls.

The application Alexander is focused on giving pilots access to is a more advanced turbulence alerting mechanism on their iPads. The airline is working with DTN, a Minnesota-based provider of actionable visual data insights primarily through web-based application programmable interfaces.“One of the exciting things we’re working on is in partnership with an organization called DTN that has a deeply advanced turbulence forecasting model, we have an agreement with them in place, where we’re looking to provide real time turbulence alerting inside the flight deck using ViaSat connectivity,” said Alexander.

Navigating around clear air turbulence is one of the crucial uses of connectivity sought by flight operations departments at commercial airlines globally. Delta pilots, for example, use cabin-based Gogo Wi-Fi as connectivity for an EFB app that uses algorithms developed by the National Center for Atmospheric Research.

The app allows Delta’s pilots to set threat index alerts generated from aircraft sensor data. The app’s algorithms use a combination of vertical accelerometer and atmospheric state data, including aircraft-specific behavioral data such as pitch, roll and wind speed to formulate app-based turbulence reports for pilots in real time.

At Qantas, Alexander wants pilots to be able to visualize where turbulence is located using DTN’s advanced forecasting model. DTN’s Flight Route Alerting engine requires Qantas pilots to provide their flight plans up to 36 hours in advance, and the service then generates weather-related impact alerts from our four-dimensional geospatial database throughout the duration of the flight.

Flight Route Alerting features 14 different weather parameters that users can choose from and a core flight hazard dataset within the alerting engine. These features have been enabled through DTN’s investments in developing a suite of mission-critical intelligence around weather-related flight hazards.

They have focused on improving their forecasting models for aviation with a focus on including flight-level specific turbulence, icing, and thunderstorm forecasts, according to Wesley Hyduke, aviation product manager, DTN.

To accompany the text-based alerts generated from DTN’s Flight Route Alerting engine, Qantas is also consuming DTN’s catalog of discrete geospatial weather data so that pilots will be able to graphically view the weather content that generated the alert, Hyduke said.

Starting in the first quarter of 2019, Qantas will begin beta testing DTN’s new NowCast rapid updating short term forecasting application designed to allow aircraft dispatchers and pilots to decide on minimum-cost tactical reroutes during flight if forecast conditions change significantly.

“By providing real time turbulence forecasting for our pilots, it brings more safety and comfort to our passengers as we can optimize flight paths through and around turbulence using a graphical display of what’s happening. Turbulence reporting currently on most commercial aircraft is limited to ACARS text-based data and sometimes that’s hard to visualize with a 4D polygon how its going to impact the aircraft. By having a graphical alert through a connected EFB, it makes it much easier to understand exactly where the turbulence is,” said Alexander.